Anti Money Laundering Guidelines For Banks

Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. EBA publishes final revised Guidelines on money laundering and terrorist financing risk factors 01 March 2021 These Guidelines are central to the EBAs work to lead coordinate and monitor the fight against money laundering and terrorist financing MLTF.

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

AMLBC18 14010012002-2003 dated August 16 2002 on the guidelines on Know Your Customer norms.

Anti money laundering guidelines for banks. When we published the first edition of the Guide our intent was to provide clear and concise answers to basic questions that surfaced in our discussions with clients attorneys regulators and others both in the United States and other jurisdictions. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. SECTOR SPECIFIC GUIDANCE FOR REGISTRANTS UNDER THE INSURANCE ACT CHAP 8401.

UAE Central Bank issues anti-money laundering guidelines for licensed financial institutions Suspicious activities should be reported through the goAML portal the regulator says The UAE has strict laws to deal with money laundering and the financing of terrorism. These steps include amendments to the Capital Requirements Directive CRD V. The Central Bank of Belize Central Bank is issuing the Anti-Money Laundering and Combating the Financing of Terrorism Guidelines AMLCFT Guidelines in its capacity as Supervisory Authority for entities as captured in the Third Schedule of the Money Laundering and Terrorism Prevention Act MLTPA and in accordance with Section 212b of the MLTPA.

The Central Bank will update or amend the Guidelines from time to time as appropriate. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Anti-Money Laundering Guidance for Banks Banks or the banking sector are under the AML obligations because they are at risk of financial crime.

Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Guideline on Anti-Money Laundering and Combatting of Terrorism Financing i P a g e TABLE OF CONTENTS LIST OF ABBREVIATIONS. Silvia Razgova The National.

In addition employees will be informed about any major changes in AML laws and regulations. The views expressed in this publication are those of the authors and do not necessarily reect the. Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector Central Bank of Ireland Page 7 13 Data Protection Firms shall comply with their obligations under Part 4 of the CJA 2010 having regard to their obligations under data protection legislation.

Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Designated Non-Financial Businesses and Professions DNFBPs Non-Bank Financial Institutions NBFIs AMLCFT and TFS for DNFBPs and NBFIsNew - 3 May 2021 APPENDIX 3. The Wolfsberg Anti-Money Laundering AML Principles for Private Banking were subsequently published in October 2000 revised in May 2002 and again most recently in June 2012. EU legislators have taken a number of steps to clarify and strengthen the important link between anti-money launderingcountering the financing of terrorism AMLCFT and prudential issues and to complement the Unions existing legal framework.

Handbook on anti-money laundering and combating the financing of terrorism for nonbank financial institutions. SECTOR SPECIFIC GUIDANCE FOR MONEY REMITTERS. AML regulations contain measures that companies must take to detect and prevent financial crimes and these regulations are determined by AML regulators and are a guide for businesses.

As such the Central Bank is hereby. Banks were advised tofollow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it. Annually will also include how to identify and follow-up on unusual or suspicious activities.

Thirteen years after the enactment of the USA PATRIOT Act and 11 years since we published the. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. Guidance on Anti-Money Laundering AML in Banking and Finance for 2021 By Jackie Wheeler May 26 2021 Anti-money laundering AML policies are put in place to deter criminals from integrating illicit funds into the financial system.

Combating the financing of terrorismI. Guidance for Banks When Providing Banking Services to Money Remitters. Asian Development Bank 2017.

Identify and verify the identity of clients monitor transactions and report suspicious. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The bank will establish a training programme on the identification and prevention of money laundering for employees who have client contact and for Compliance personnel.

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Compliance Officer Nomination Notification Form New - 3 May 2021.

Anti Money Laundering Overview Process And History

Anti Money Laundering Is Used In The Finance And Legal Industries To Meet The Legal Requirements For Money Laundering Financial Institutions Financial Services

Get Our Sample Of Anti Money Laundering Policy Template Policy Template Money Laundering Policies

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

How Banks Can Solve The Anti Money Laundering Challenge Money Laundering Solving Challenges

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Agenci Financial Institutions Requirements Engineering Regulatory

Anti Money Laundering Infographic 2014 Money Laundering Infographic Risk Management

Live Webinar On Aml Bsa Boot Camp Bank Secrecy Act New Cdd Requirements Current Aml Issues Bank Secrecy Act Acting Bootcamp

How Does The Eu S Anti Money Laundering Directive Impact The Digital Identity Verification Process Softelligence

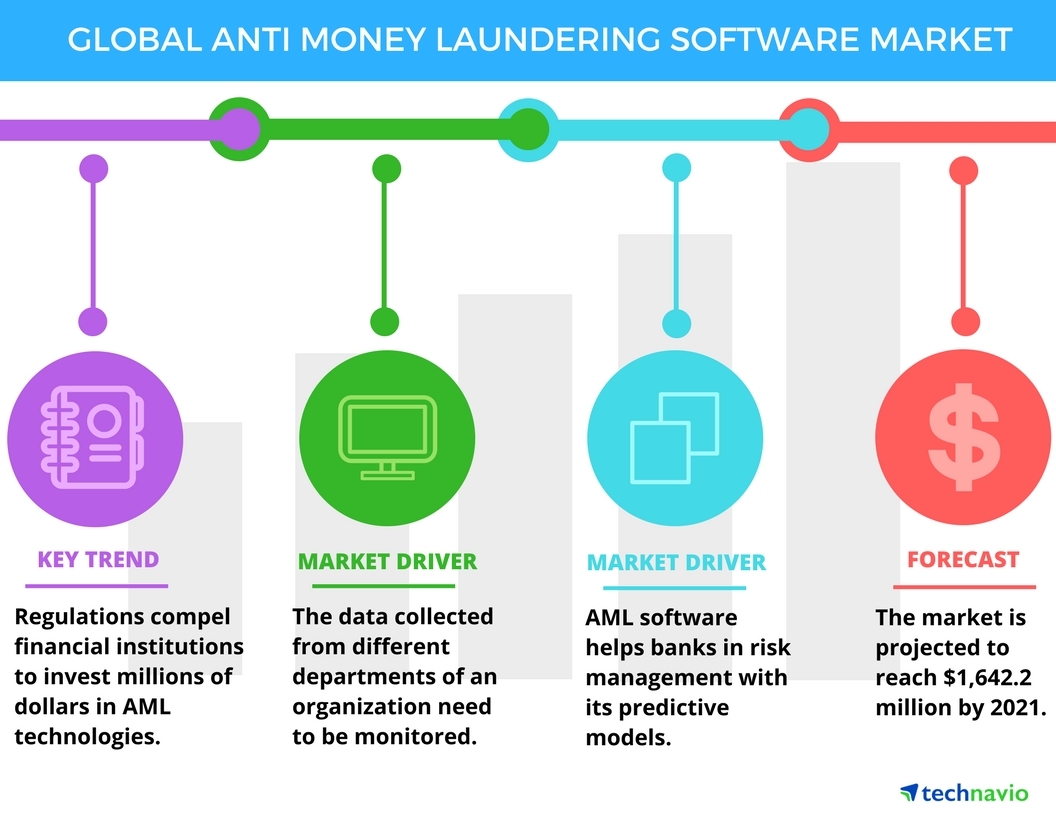

Global Anti Money Laundering Software Market Drivers And Forecast From Technavio Business Wire

Anti Money Laundering Aml Investigation Money Laundering Case Management Investigations

Basic Stages Of Anti Money Laundering Money Laundering Case Management Know Your Customer

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Revised Central Bank Amla Guidelines Anti Money Laundering

Casino Govt Regulations Include Safeguards Designed To Prevent Money Laundering By Junkets Infographic Money Laundering Prevention Infographic

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Anti Money Laundering Aml Investigation Money Laundering Know Your Customer Investigations

Post a Comment for "Anti Money Laundering Guidelines For Banks"