Penalty For Money Laundering In South Africa

Are visiting lawyers subject to local laws regarding anti-money laundering and if so to what extent. Money laundering in South Africa Louis de Koker.

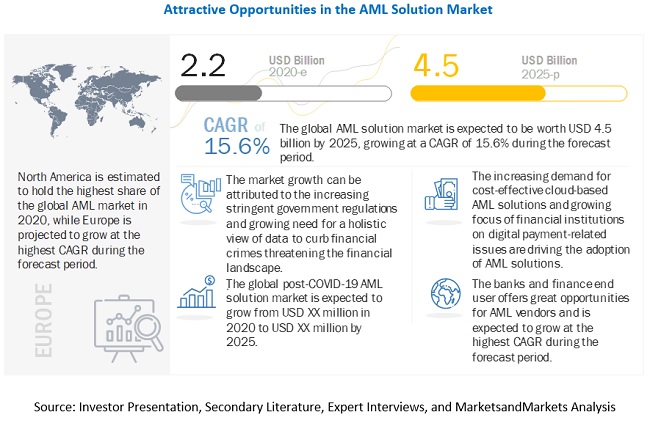

Anti Money Laundering Software Market To Rise At Cagr Of 13

There are several main sections of POCA which deal with money laundering control.

Penalty for money laundering in south africa. And unlawful acquisition possession and disposal of unwrought gold. Liability for money laundering extends to both natural and legal persons and proof of knowledge can be derived from objective factual circumstances. This chapter reviews developments in establishing systems to combat money laundering and the financing of terrorism since 2004.

Financial institutions that do not comply with AML compliance are fined. Failure to keep records will therefore result in R100 million or 15 years imprisonment. In South Africa those found guilty of this white-collar crime face penalties ranging up to R1 billion and life imprisonment while companies that fail to mitigate operational financial legal and reputational risk.

In this sense money laundering control is based on the premise that banks must be protected from providing criminals with the means to launder the benefits of their. Financial institutions aim to ensure AML compliance by making controls according to regulations. The maximum penalty that may be imposed for the crime of money laundering involves either a fine of up to R100 million rand or a prison sentence of up to 30 years.

South Africa prevents financial crimes with the AML regulations they publish. Centre for the Study of Economic Crime. Failure to identify persons will therefore result in R100 million or 15 year imprisonment.

The maximum penalty that may be imposed for the crime of money laundering involves either a fine of up to R100 million rand or a prison sentence of up to 30 years. Offences subject to penalties includes the following. The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie.

And unlawful acquisition possession and disposal of unwrought gold. The South African government aims to prevent money laundering by strengthening anti-money laundering regimes. In addition if money laundering.

Money laundering sentence south africa. A person convicted of these offences can be fined up to ZAR100 million or be sentenced to imprisonment up to 30 years. These were discussed at a workshop on December 5 2001.

A financial penalty of R30-million and a directive to take remedial action for failure to comply with suspicious and unusual transaction reporting requirements in terms of. Destroying or tampering with record will also result in penalties. This is addressed in more detail in 313 Money Laundering below.

RAU University 1 Introduction 2 The money laundering concept in South African law 21 General money laundering offences 22 Defence and penalties 23 Money laundering and racketeering 24 Reporting of suspicious transactions 3 Money laundering trends and. Penalties range up to R1 billion and life imprisonment. Any visiting attorney committing any of the offences contemplated in POCA PRECCA and POCDATARA shall if convicted be liable to fines or to imprisonment.

Is applicable to every person in South Africa irrespective of whether you are a member of an accountable institution or not. It takes place through a variety of schemes which include the use of banks. Money laundering sentence south africa.

These offences can be committed negligently by businesses as well as their managers and employees who fail to comply with their duties under the anti-laundering legislation. What are the Penalties for Money Laundering in South Africa. Money Laundering offences.

This is addressed in more detail in 313 Money Laundering below. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa. Data Systems.

Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years. Money laundering is one of the most serious financial offences that can be committed under local and international law. A maximum period of imprisonment of five years or a fine not exceeding R10 million per contravention.

Money laundering promotes criminal activities in South Africa because it allows criminals to keep the benefits that they acquired through their criminal activities. The penalties for money laundering are a fine not exceeding. The strategic plan offers a convenient backdrop partly because the plan is due for implementation during a period that.

South Africas initiatives to address money laundering date back to the 1990s while measures to combat funding of terrorism are more recent. The maximum penalty that may be imposed for the crime of money laundering involves either a fine of up to R100 million rand or a prison sentence of up to 30 years. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing.

Outlines the 1998 Proceeds of Crime Act POCA the 1992 Drugs and Drug Trafficking Act and their general money laundering provisions including negligence and intent defence and penalties. Money laundering is one of the most serious financial offences that can be committed under South African law. Is also a broad range of ancillary offences to the money laundering offences.

Reports a study by the Centre for the Study of Economic Crime at Rand Afrikaans University into the characteristics of money laundering schemes in South Africa. If found guilty under POCA you will be subject to the penalties listed in the Act.

Basel Anti Money Laundering Index

The Development Of A Single Anti Money Laundering Rule Book Ey Netherlands

Anti Money Laundering 2021 Germany Iclg

Anti Money Laundering Market Size Trends Forecast 2026

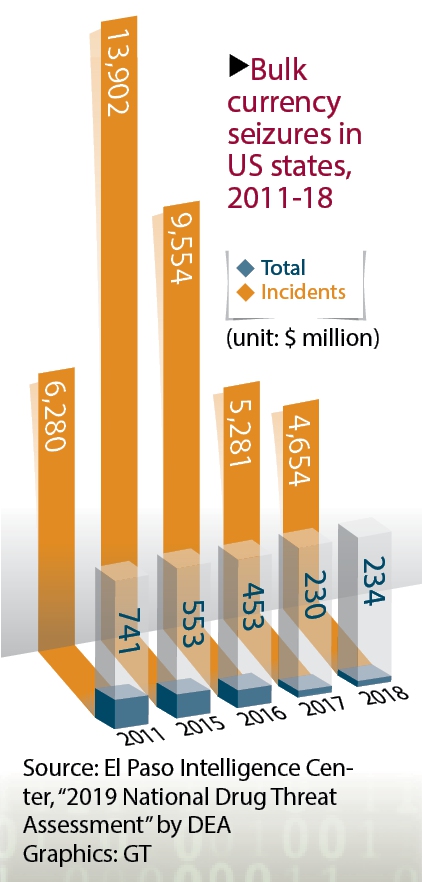

Latin American Crime Cartels Turn To Cryptocurrencies For Money Laundering Global Times

Development Of An Anti Money Laundering System Alten Group

Reference Guide To Anti Money Laundering And Combating The Financing Of Terrorism Second Edition And Supplement On Special Recommendation Ix

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Aml Anti Money Laundering Cash Coin Transaction Vector Image

Pdf International Anti Money Laundering Programs

Anti Money Laundering Risk In Trade Finance Trade Finance Money Laundering Finance

What Is Money Laundering And How Is It Done

A Comprehensive View Of Money Laundering Methods Old And New Acams Today

Pdf A Review Of Money Laundering Literature The State Of Research In Key Areas

The Evolution Of Economic Crime In South Africa Crime In South Africa South Africa Africa

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Post a Comment for "Penalty For Money Laundering In South Africa"