What Are The Money Laundering Regulations 2017

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. If you dont do anything thats caught by the 2017 Money Laundering Regulations then none of this applies to you.

Brussels Wants A New Eu Agency To Tackle Money Laundering Euronews

They also confirm firms may outsource CDD but.

What are the money laundering regulations 2017. The 2017 MLRs have been. Carry out a detailed risk assessment focusing on customer behaviour delivery channels and so on. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures.

But the administrative requirements of the Money Laundering Regulations may not. 2 These Regulations come into force on 26th. Auditors insolvency practitioners external accountants and tax advisers.

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. To qualify that slightly the Proceeds of Crime Act and Terrorism Act always apply ie. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor.

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations replaced the Money Laundering Regulations 2007 with updated provisions that implement in part the EU Fourth Money Laundering Directive which in turn applied the latest Financial Action Task Force FATF standards.

HMRC recommends that organisations. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs.

Today the Money Laundering Regulations 2017 MLRs 2017 or Regulations has become effective transposing Fourth Money Laundering Directive EU 2015849 - 4AMLD into UK law. The regulations apply to. Businesses regulated by MLR 2017 must assess the risk that they could be used for money laundering including terrorist financing.

AML and counter-terrorist financing CTF. Not get involved in ML report suspicions not tip off etc. Identify the money laundering risks that are relevant to their business.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 commenced on 26 June 2017 and replace the Money Laundering Regulations 2007. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory.

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued By Cima Money Laundering Fund Cayman Islands

Http Www Europarl Europa Eu Regdata Etudes Brie 2017 607260 Eprs Bri 2017 607260 En Pdf

Anti Money Laundering Software Money Laundering Portfolio Site Personal Website Portfolio

Service Blueprint Anti Money Laundering Law Money Laundering

Anti Money Laundering Policy Pdf

Eu Policy On High Risk Third Countries European Commission

Identitymind Risk Management Anti Money Laundering And Fraud Prevention Risk Management Money Laundering Understanding

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued By Cima Pur Money Laundering Fund In Writing

Get Our Sample Of Anti Money Laundering Policy Template Policy Template Money Laundering Policies

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued Money Laundering Fund Management Compliance

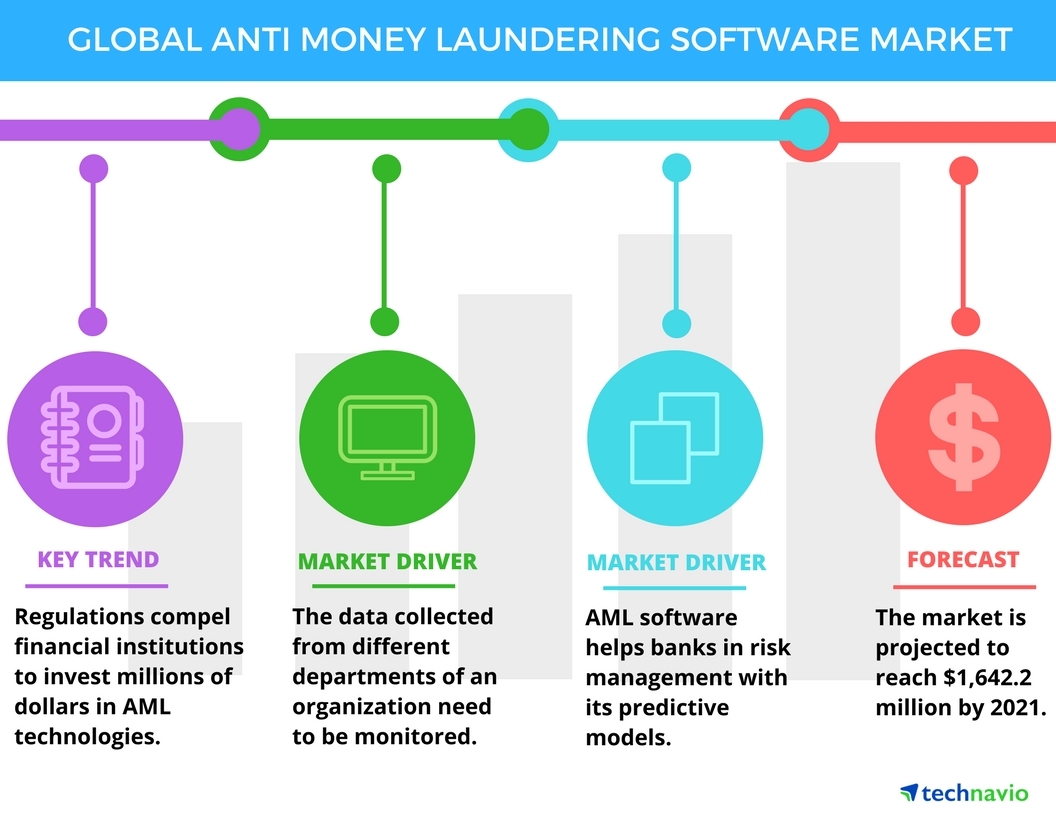

Global Anti Money Laundering Software Market Drivers And Forecast From Technavio Business Wire

Pdf Anti Money Laundering Regulation And The Art Market

The Views Of 900 Senior Compliance Practitioners Benchmark Your Practices And Expectations On Budgets Resources And Te Budgeting Financial Services Fintech

Https Www Europarl Europa Eu Regdata Etudes Idan 2021 659654 Ipol Ida 2021 659654 En Pdf

Anti Money Laundering Regulations In Turkey Criminal Law Turkey

Cryptocurrency Money Laundering Explained Bitquery

Post a Comment for "What Are The Money Laundering Regulations 2017"